Mortgage costs, valuation costs, mortgage opening commission, stamp duty and notarial fees, as well as mortgage and capital gain taxes - find out what costs are connected with buying property in Spain. We indicate which costs are mandatory and which may be passed on to the lending bank.

Taxes, fees and transaction costs connected with buying property may differ, depending on:

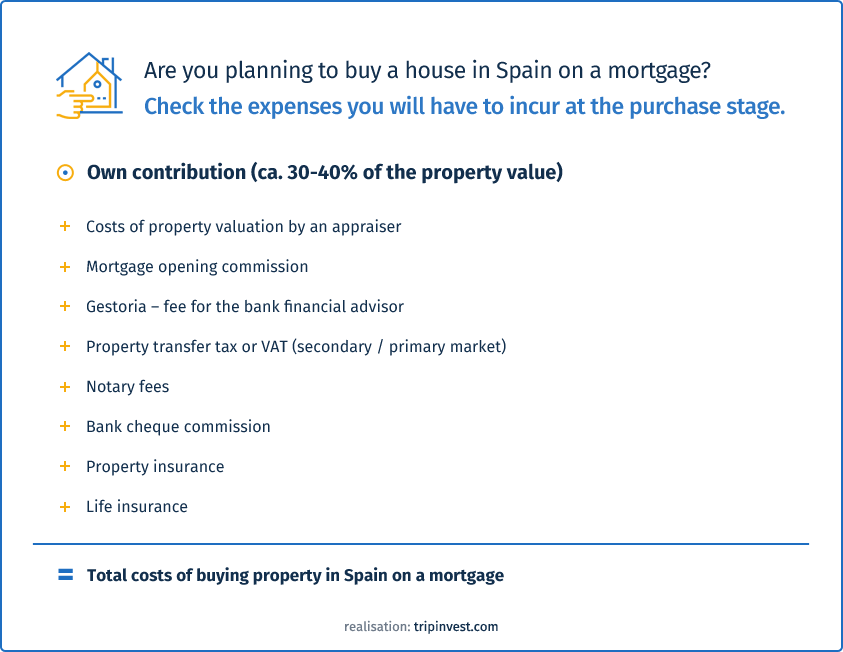

Buying property in Spain is connected with incurring additional costs related to the execution of the transaction itself and the mortgage service. However, it is worth knowing that not all the costs associated with the mortgage have to be borne by the buyer. Therefore, if you are at the stage of choosing the most favourable mortgage offer, check what costs are associated with the purchase transaction itself. And also which of these costs will have to borne by you and which costs may be avoided.

If you do not want to overpay, choose a good real estate agency. Unfair agencies can impose additional costs during the purchase process. If you want to avoid surprises, choose the tripinvest agency. We will realistically inform you about the costs at the beginning of the cooperation and we will not surprise you with any additional costs later on.

The valuation of the property must be carried out by an appraiser appointed by the lending bank. The purpose of the valuation is to check whether we are applying for a mortgage of the right amount, or whether it is possible that a mortgage application of 60/70% of the property value is higher than the genuine property value.

The final cost value depends on the type and value of the property. The appraiser's costs are borne by the buyer and range on average from 300 to 600 Euros.

Banks and financial institutions in Spain determine the value of mortgages based on floating interest rates linked to the annual EURIBOR interest rate plus a margin. Banks may set their own level of margin, but due to high competition, rates are generally at similar levels.

When choosing a loan with a floating interest rate, you will pay interest at the EURIBOR rate plus a margin for the lending institution. In recent years, the EURIBOR rate has been negative, which is why banks have been willing to provide mortgages with a floating interest rate, plus about 2-3% margin. For instance, at the beginning of 2019, the EURIBOR rate was at the level of - 0.37%. At that time, with a floating interest rate of 1.8% - 3%, theoretically only 1.43% could be paid. Mortgages with a floating interest rate are popular mainly among native Spaniards. However, clients outside of Spain usually opt for a mortgage with a fixed interest rate, which guarantees full security.

The biggest advantage of choosing a mortgage with a floating interest rate in Spain is the possibility to take advantage of cheaper mortgages thanks to the negative EURIBOR rates. The downside is that you do not know the fixed interest rate of the mortgage, and over time the value of interest may increase, which means that you may pay a much higher mortgage installment than that calculated on the day of property purchase.

If you are interested in a fixed rate mortgage, you can choose fixed rate mortgages with an average of 2.5 - 3.5%. The disadvantage of a fixed rate mortgage is that the current mortgage instalments are slightly higher than those of a floating mortgage rate. However, the advantage is that you know the exact value of the mortgage instalments over the entire repayment period.

Due to the slight difference between fixed and floating rates, fixed rate mortgages are by far the safest form. When choosing a fixed rate mortgage, you are guaranteed the amount of instalments, regardless of the Spanish economic situation. It is also worth mentioning that mortgages with a fixed interest rate are the most popular among clients from the United Kingdom.

According to the Spanish Mortgage Credit Law, it is a commission that a financial entity may charge in connection with the granting of a mortgage. The amount of that commission is not regulated by law. It is usually regulated by the market. All banks charge a fee for setting up a mortgage and the value of this fee depends on the amount of mortgage. Usually, it is a charge of 0.5 - 3% of the mortgage amount.

Generally, the catalogue of commissions that a bank can impose on a borrower is a closed catalogue, which means that banks can not impose just any number of commissions on the borrower. When taking out a mortgage, the following costs should also be considered:

Certain banks demand documents in English and some prefer the documents to be submitted in Spanish. This means additional translation costs since the bank does not take responsibility for the cost of translations - most often it expects the Client to submit already translated documents. If the bank prefers the documents in Spanish, the client will have to bear the cost of a sworn translator. The price of translations depends on the selected offer, as well as on whether we demand an express service or a service over a normal period of time. Nevertheless, if you are in no hurry to buy property, it is worth thoroughly looking around in the sworn translators' offers so as not to overpay.

If you decide on express translation in Spain, the cost can be as high as 700 Euros.

When granting mortgages, Spanish banks use the services of an institution called 'Gestoría', which is characteristic of the Spanish property market. The Gestoria are nothing else than companies or experts who deal with the payment of taxes, mortgages and the registration of property deeds. It is the bank that chooses the specific service of the gestoria. The fee for the work of bank experts depends on the value of the mortgage and the workload. This cost is imposed by the bank on the Client of the mortgage and it is rather impossible to avoid it. Most often it fluctuates at 1% of the transaction value.

There is an additional fee for taking out a mortgage – the AJD tax. The AJD tax on civil law activities is on average about 0.5% - 1.5% of the value of property indicated in the notarial deed. If you buy the property for cash, this fee will not apply to you.

Until recently, this fee was transferred to the account of the State Treasury by the property buyer. However, by court decision of 2019, it is the banks that are obliged to pay the fee. Therefore, it is worth making sure that it is the bank that bears the fee and does not pass it on to the borrower.

The amount of transfer taxes related to the purchase of property from the secondary market depends on the region of Spain. The average transfer tax is about 10% (Alicante region). Generally, the amount of the tax may be different for certain regions of Spain.

However, if you have bought a property from the primary market, you will be charged a Value Added Tax (Impuesto sobre el Valor Añadido - IVA). The tax on property purchased from the primary market is 10%.

At the same time, you can benefit from a number of tax credits in Spain. For instance, you can deduct certain costs from the interest on your mortgage e.g. the costs related to repairs, renovations, maintenance and leasing fees.

The finalisation of the transaction requires the preparation of an appropriate notarial deed and the issue of a certificate from a notary public on the conformity of all necessary documents. Notary fees related to the preparation of the land registry can be paid by the buyer as well as by the bank granting the loan. These fees are usually paid by the Gestoria.

The commission is 0.4% of the value of the cheque, unless we have a property insurance policy in the bank - in that case, we pay half of the value.

If you use the services of the tripinvest agency, we will check whether the commission for the bank check has been issued in the correct amount. Sometimes banks issue several cheques and charge separate commissions for them. Therefore, we check whether the bank cheques have been charged only one commission, so that you pay as little as possible.

When you take out a mortgage, you are required to take out property and life insurance. Most of the times, banks also offer a complementary service of mortgage insurance and insurance cover in case of difficulties in paying off the loan, as well as other insurance products. It is worth remembering that the borrower is not obliged to take out all the insurance policies offered, which are usually much more expensive than competitive products offered on the market. The amount of insurance depends on many factors, including the value of the property, the age of the insured, the terms and conditions of the property financing, etc.

The bank can not prohibit the client from taking out other external insurance, e.g. for a house, or continuing the existing insurance after the previous owner. However, our experience proves that banks often hinder the case if we are not interested in their insurance offer - additional formalities, requirements for a competitive insurance offer, providing additional documentation, etc. Therefore, we always encourage you to compare the insurance offer of the lending bank and competitive offers and to consider whether it would be safer and more convenient to take out insurance in the lending bank.

Presented below is a sample calculation of the property acquisition in Spain in 2019, which has been financed by a mortgage taken out in Spain in Euro.

Mortgage terms for a sample property in Spain

|

COST CALCULATION OF BUYING A HOUSE IN SPAIN

|

Check what financial resources you need to have to buy property in Spain.

|

THE EXPENSES YOU WILL HAVE TO INCUR AT THE PURCHASE STAGE

|

Other expenses related to the purchase of property, which are borne by the buyer or the bank

|

ADDITIONAL COSTS

|

When estimating the return on investment, you must therefore assume that, when presuming an increase in the value of the property over time, you will need several years to balance the costs associated with buying the property.

Of course, the final value of the mortgage and costs depends on many factors, including mainly the attractiveness of the property and the individual creditworthiness of the investor. For the purpose of the calculation we have chosen an average value of costs. However, if you would like to know how much your investment in a particular property will cost, please contact us. We will find the right property for you, prepare individual calculations, and advise you on how to safely invest your capital.